Regulatory & Compliance Law

This section contains public-interest disclosures involving breaches of statutory and regulatory duties by corporations, public bodies, regulated professionals, financial institutions, enforcement agencies and any entity operating under a licensed or supervised framework. Matters placed here include failures to meet regulatory standards, non-compliance with mandatory processes, inaccurate or misleading reporting to regulators, obstruction of supervisory oversight, and conduct contrary to sector-specific legal requirements. Each disclosure sets out the evidential record, the statutory or regulatory regime engaged, and the compliance failures that have given rise to public-interest concern.

1. Statutory Compliance Failures and Licensing Obligations

I. Financial Services and Markets Act 2000 (FSMA) — Conduct of Regulated Activities

Disclosures in this category include failures by authorised firms to act in accordance with FSMA requirements for transparency, accurate information, fair treatment, and lawful execution of regulated activities. Conduct that misleads consumers, obscures material facts, or breaches regulatory permissions is recorded here as a failure of statutory compliance.

II. Consumer Credit Act 1974 — Disclosure, Notice and Enforcement Duties

Many matters involve lenders or credit providers failing to issue mandatory notices, mis-stating balances, altering records without justification, or engaging in enforcement action that does not comply with statutory procedures. These omissions breach the Act’s requirements for clarity, fairness and accuracy in consumer credit dealings.

2. Regulatory Standards, Supervision and Industry Rules

I. FCA Handbook — Principles for Businesses (PRIN)

Disclosures frequently involve breaches of core regulatory principles, including integrity, skill, care, diligence, fair treatment and proper organisation of business affairs. PRIN imposes a high standard of conduct; failures to follow these principles often result in consumer harm or procedural obstruction.

II. Sector-Specific Codes and Mandatory Guidance

Some matters involve breaches of conduct rules or professional codes that govern regulated sectors, including insurance, telecommunications, utilities, financial services and professional practice. Non-compliance with binding guidance or sector rules is documented where it forms part of the harm or obstruction experienced by the claimant.

3. Reporting Duties, Information Accuracy and Record Integrity

I. Regulatory Reporting Obligations — Accuracy and Transparency Requirements

Matters in this category frequently include inaccurate reporting to regulators, omissions of material information, failure to notify required events, or misrepresentation of compliance status. Regulatory frameworks impose strict duties to maintain accurate records; deviations undermine market integrity and public trust.

II. Data Protection Act 2018 / UK GDPR — Accuracy and Accountability in Regulatory Contexts

Many disclosures arise from incorrect or altered records held by regulated firms, including incomplete files, unrecorded correspondence, or the manipulation of data used to justify decisions. Such actions breach both data-protection law and sector-specific record-keeping obligations.

4. Enforcement Failures, Supervisory Breakdown and Procedural Obstruction

I. Regulator Duties to Investigate, Respond and Enforce

Disclosures also include situations where regulators fail to act on complaints, decline to review evidence, or allow non-compliant actors to continue operating without intervention. These omissions undermine the statutory purposes of regulatory bodies and contribute to continued consumer detriment or systemic failure.

II. Misuse of Regulatory Process and Procedural Obstruction

Cases may also involve firms misusing regulatory mechanisms to intimidate, delay, or overwhelm complainants, including the deployment of incorrect processes, non-response to mandatory channels, and obstruction of lawful review. Such conduct undermines the regulatory system and violates statutory expectations of fair dealing and good faith.

All Disclosure Cases Listed

Reading County Court, A nexus of procedural breakdown, lost filings, and judicial inconsistency across multiple Deputy District Judges.

-

Image

Embedded across NHS, insurers, and public-sector contracts, DAC Beachcroft’s dual role blurs state and commerce, turning governance itself into a client.

-

Image

Theale Surgery, where clinical duty met the shadow of its own defence firm, DAC Beachcroft LLP.

-

Image

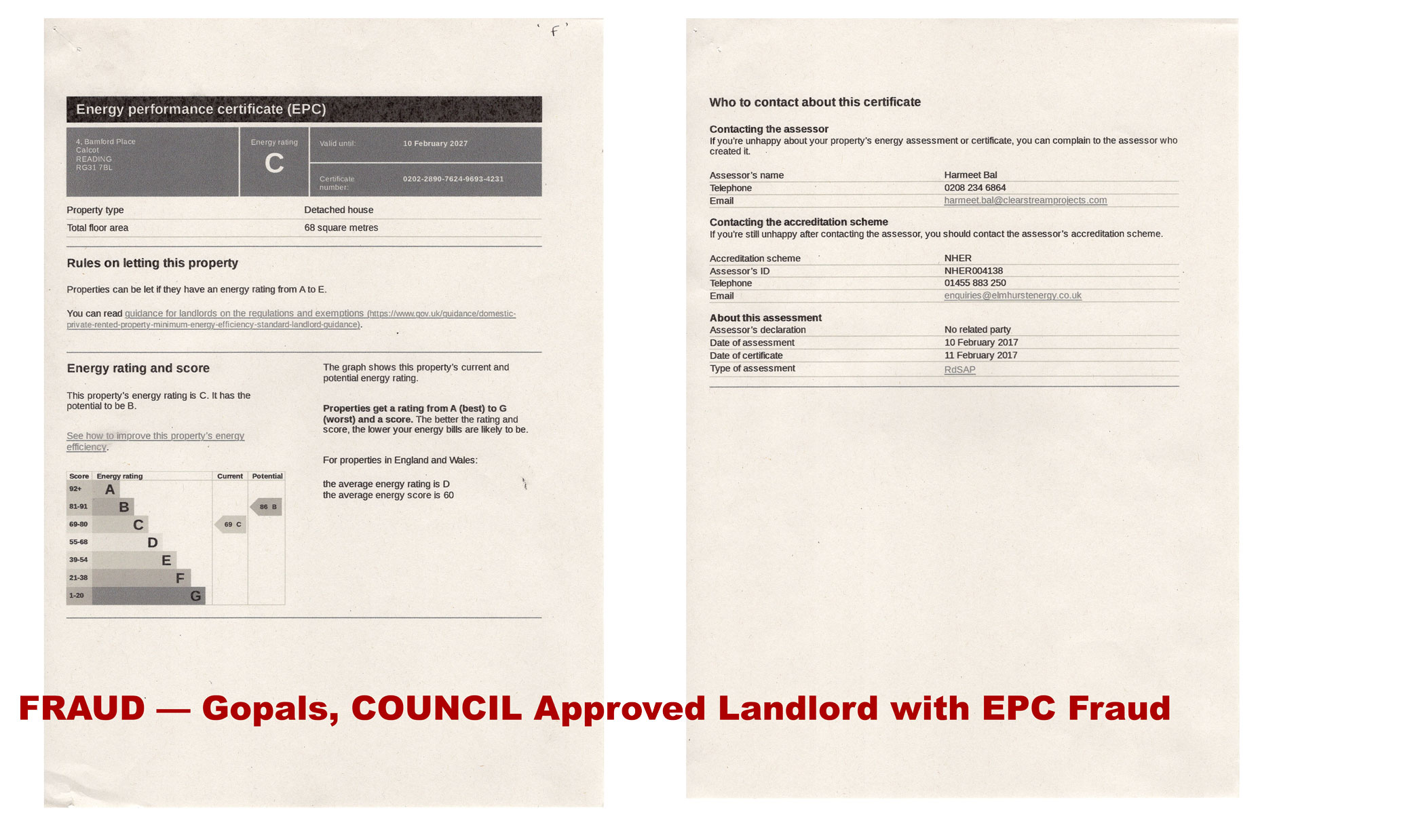

From landlord misrepresentation to judicial neglect — a closed civic circuit of fraud and verification failure.

-

Image

DWP / Universal Credit headquarters site of unresolved welfare-administration breaches.

-

Image

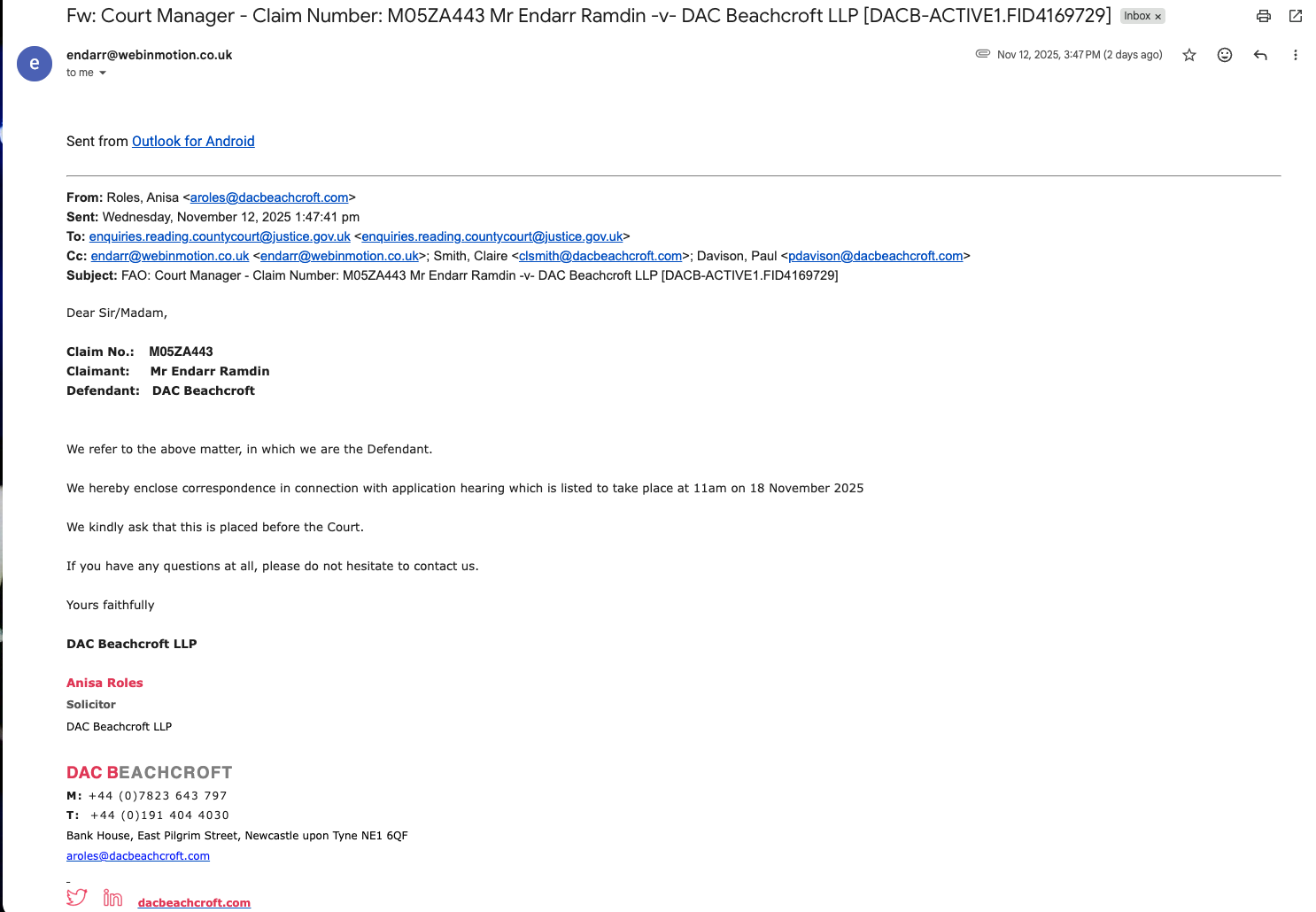

Service by unapproved channel during active proceedings a departure from rule-based process.

-

Image

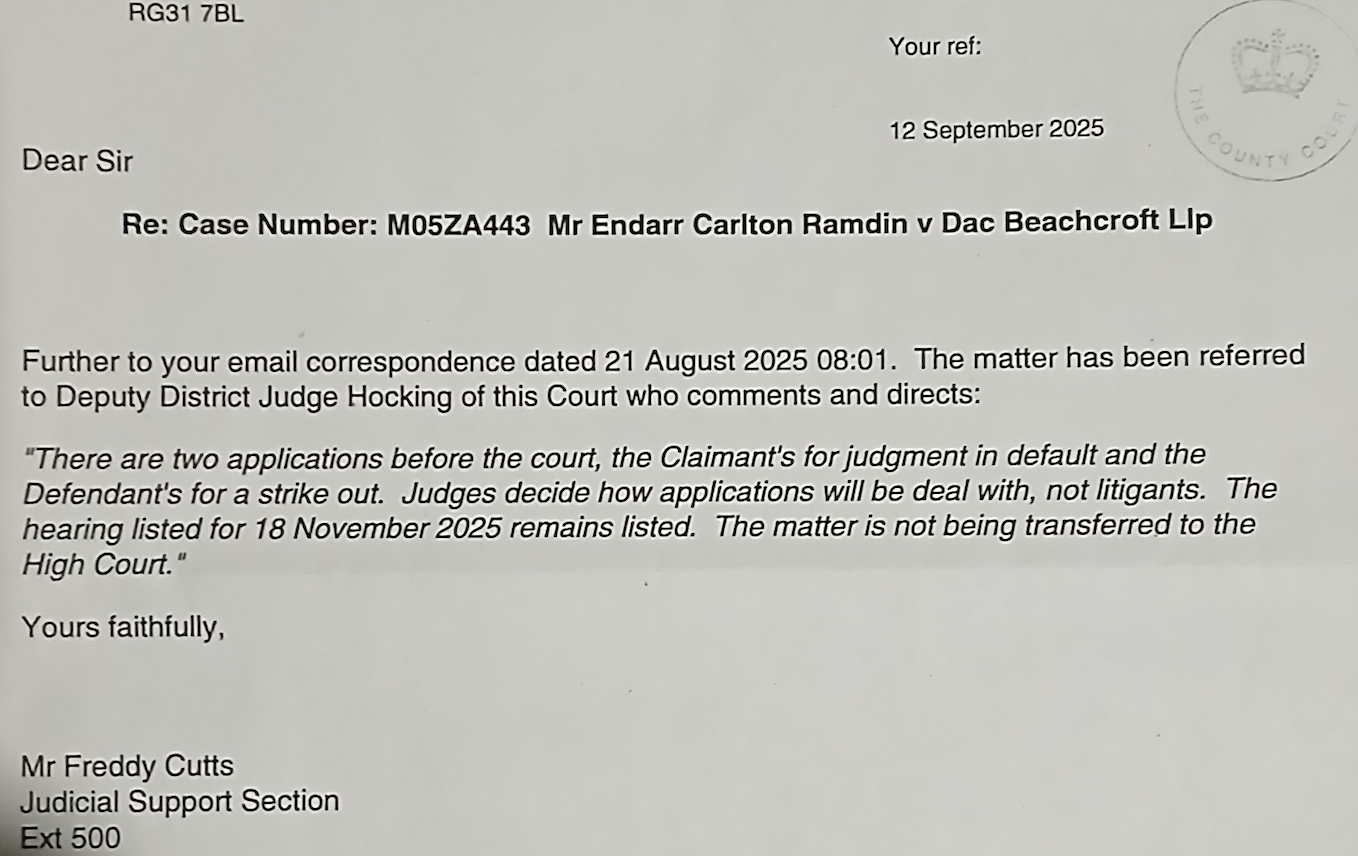

Judicial correspondence diverging from the Civil Procedure Rules before adjudication has begun.

-

Image

A skeleton argument served into a silent court — evidence of procedural interference layered on top of judicial freeze.